While it remains a relatively new concept, asset tokenization is being deemed as one of the most compelling applications of blockchain technology amongst experts. Backed by benefits like greater portability, improved security, increased efficiencies, and fractionalization, asset tokenization has massive potential and is becoming impossible to ignore.

It is transforming finance with enhanced security and liquidity. Not to mention, there is a less obvious benefit here, which is the value of real-world assets. With this level of potential, it is not an understatement to say that the momentum surrounding asset tokenization is growing. While there are many benefits and opportunities with asset tokenization, its success hinges on some challenges.

Explaining asset tokenization

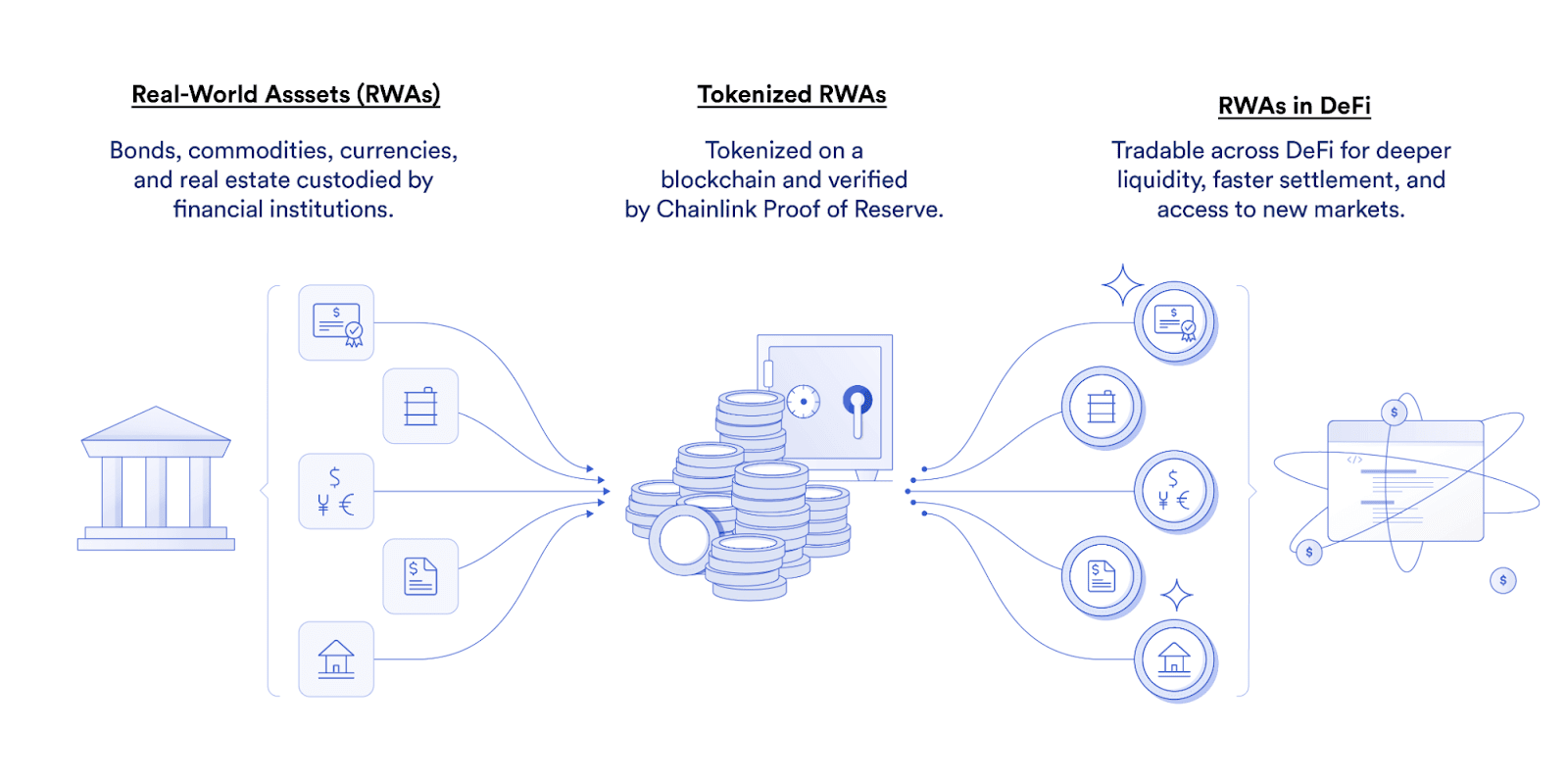

Asset tokenization is the process of turning physical assets, like real estate, stocks, paintings, and commodities, into blockchain-based digital tokens. It entails converting the ownership rights and features of a specific asset into a digital form. This can then be divided into smaller units and traded on a blockchain tokenization network.

It allows assets that are typically illiquid, costly to trade, or inaccessible to be represented as tokens with specific ownership rights and properties. The tokens are often made using smart contracts, which are self-executing contracts with terms written into code. The tokens representing the underlying assets can be transferred, bought, and purchased—enabling fractional ownership and establishing liquidity.

Every token usually represents a share or fraction of the underlying asset, allowing users to own a portion of the asset without needing to purchase the full asset. When talking about asset tokenization, it is important to note how it contrasts with the securitization of assets. The securitization process entails pooling certain illiquid asset classes so that they can be repackaged into securities.

With asset tokenization, nearly all real and virtual assets can be converted into digital tokens. To tokenize an asset, it is important to have some level of understanding of smart contracts. Digital tokens backed by underlying assets are both executed and controlled utilizing a smart contract.

The smart contract is self-executing and self-enforcing in that it is where the conditions of the parties’ agreement are put into lines of code. When the contract conditions are met, the tokens are then transferred to investors directly using the smart contract.

This offers users accuracy, efficiency, and transparency since the historical data and contractual terms are available publicly. Some examples of real-world assets that can be transformed into tokens include intellectual property, commodities like gold, oil, art, collectibles, or real estate.

Benefits of asset tokenization

Tokenization can bridge the gap between the traditional and digital worlds while increasing liquidity, improving the accessibility and inclusiveness of assets, and unlocking global market opportunities for investors.

Tokenizing an asset presents many opportunities, like increased liquidity. Asset tokenization improves asset liquidity by allowing for fractional ownership. This means that when a user purchases fractions or smaller amounts of an asset, it lowers the barrier to entry and enables greater market engagement.

This level of liquidity can attract a broader range of investors as well—and even potentially boost the trading volume of a specific asset. Tokenization also has the potential to make illiquid assets more accessible to investors.

Fractional ownership means the minimum investment amount required to participate in specific assets is lowered. This balances investment opportunities but also enables investors with less capital to diversify their portfolios. Asset tokenization can unlock global markets, too.

It does this by alleviating regional barriers, but also minimizing the complexities that arise with cross-border transactions. Investors from different countries can engage in tokenized assets, offering chances to increase market efficiency and diversity.

Challenges with asset tokenization

Being a novel concept, asset tokenization is constrained by regulatory obstacles, liquidity risks, and little market maturity. These hurdles can be overcome, but it is still important to be aware of them when considering tokenizing assets.

As asset tokenization is a relatively new concept, its regulatory frameworks are continuously changing. Depending on the jurisdiction, tokenized assets could face regulatory uncertainties. This makes compliance with securities laws rather challenging.

There is also the possibility of liquidity risks with asset tokenization. Although tokenization can improve liquidity, it could also expose the assets to a greater volatile nature of the market. Tokenized assets could experience significant price fluctuations as a result of the risky nature of the crypto market.

This could impact investor confidence, too. If there is limited trading volume or not enough demand, liquidity can also be negatively affected. While there is a growing interest in tokenization, the market is still very much in its early stages of development.

The marketplaces and infrastructure allowing for the tokenization of assets are not as established as traditional financial markets. The lack of maturity here can create uncertainties like challenges concerning valuing tokenized assets accurately. To realize the true potential of asset tokenization, we must find ways to overcome these challenges.

Developing clear guidelines and frameworks will prove beneficial in driving compliance while also protecting investors. Additionally, developing standardized valuation methodologies will help with asset valuation and price discovery by promoting fair pricing and transparency. With all of this in mind, these challenges must be addressed to allow for successful implementation.

The future of asset tokenization

Tokenization offers many of the appreciated benefits of blockchain. These include reduced costs, increased liquidity, and enhanced transparency. However, there is also another less obvious benefit here: the underlying value of real-world assets.

This is what makes asset tokenization an attractive choice for investors. With asset tokenization, they can access new markets, diversify their portfolios, and get exposure to illiquid assets. While it is still a novel concept, the market continues to grow, and we are sure to see more experimentation happening here.

However, there is still a need to address the current challenges with asset tokenization, such as liquidity risks and regulatory obstacles. These challenges hinder the successful implementation of asset tokenization. By overcoming these challenges, we can truly realize the power of asset tokenization to revolutionize the finance industry.

The advances in technology turning blockchain mainstream | Opinion